China's Coal to Chemicals: Guest Post by Rembrandt

The following article by Rembrandt was originally posted at The Oil Drum

In this post, I give an overview of developments in China to create a coal to chemicals industry, primarily using methanol as an intermediary feedstock. In doing this research, to my surprise, I found that the Chinese chemical economy is advancing rapidly in its use of coal as a chemical feedstock, as opposed to crude oil in other countries. In many cases, coal already represents 20% or more of chemical feedstocks, and in special cases such as PVC, the country already sources virtually all of its input from coal. Since China produces 20% of the world's PVC, such transitions have a substantial impact on the global energy system.

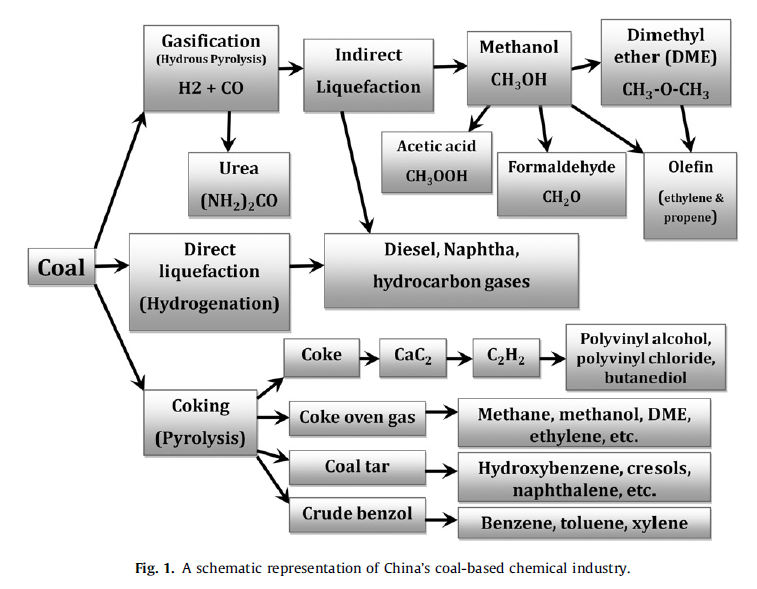

The primary raw chemical input produced from coal is methanol, which is produced through coal gasification and subsequently, methanol synthesis and refining (see picture below for overview of process steps).

Figure 1 - Block flow diagram of coal to methanol synthesis. Source: Inouye et al. 2008

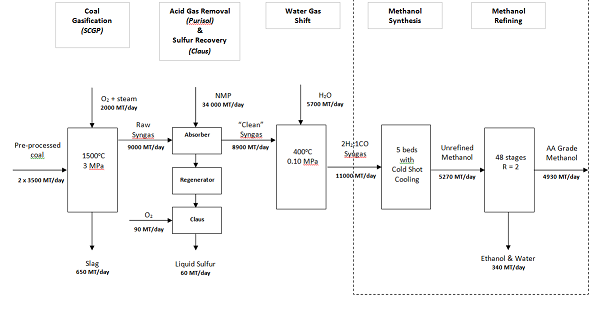

Today, methanol is used to produce a wide variety of chemicals including formaldehyde, MTBE, acetic acid, DME, esters, olefins, and other products. These are used for fuels, pesticides, medicines, plastics, fibres, resins, etc. China currently produces approximately 25% of the world’s output of methanol.

Figure 2 - Products produced in the coal to chemical's industry of today. Source: Yang and Jackson 2012

The current status of China’s coal to chemical industry.

Since 2000, China has been investing an increasing amount into the production of coal-based petrochemicals, substituting these for traditional crude oil based processes. The plausible reasons are the cheap price of coal and the strategic desire to be self-sufficient in resource inputs. The industrial base originally focused on five areas of petrochemical replacement. More recently, the industry is gearing up to produce other petrochemicals by Chinese R&D, and through establishing technology partnerships with non-Chinese players such as TOTAL Oil Company.

The five base chemical products currently made from coal in China are:

• Light oil (containing benzene, toluene and xylene) as a by-product of coke oven steel industry operations. The COLO (coke oven light oil) is utilized in the production of aromatics. It has been estimated that approximately 27% of benzene production in China is coming from this source. Benzene is a precursor for tens of thousands of chemical products including cosmetics, drugs, pesticides, lubricants, dyes, explosives, detergents, nylon, polymers, and plastics. Source: Jeffrey Plotkin 2012

• Acetylene used for production of vinyl chloride monomer (VCM) and 1,4 Butanedoil (BDO). VCM is used to produce polyvinyl chloride (PVC) plastics. BDO is used for a variety of plastics, elastic fibres, and polyurethanes. It is estimated that approximately 85% of VCM produced in China is through coal based routes. Source: Jeffrey Plotkin 2012

• Urea and Ammonia used mainly for the production of fertilizers. Roughly 70% of nitrogen fertilizers in China are produced from coal feedstocks, and all expansion in the future will likely be coal, given the lack of natural gas supplies in China. Source: China Fertilizer Consultants 2010

• Coal to Olefins (CTO), also referred to more commonly as alkenes. These are used to process into a large number of other building block chemicals including ketones, carboxylic acids, ethylene, and alcohols. The first commercial plant was started in 2010.

• Monoethylene Glycol (MEG) production, utilizing a new process route based on gasification of coal with several further reactions to obtain methyl nitrate into dimethyl oxalate into MEG. The first commercial plant began operating in 2009 at a rate of 200,000 tons per year.

Future ventures

The country's industry is expanding its current operations rapidly, as well as implementing new process routes. For example, the company Celanese is looking at commercializing technologies to produce ethanol from coal. A few of the upcoming developments include:

• Dow Chemicals together with Shenhua will launch a large multi million tonnes coal to many chemicals plant in 2016, called the Yulin Integrated Chemicals project, for the production of methanol, methanol to olefins, monoethylene glycol, ethanolamines/ethylendiamines, polyether polyols, acrylic acids, acrylic esters, chlorinated methanes, ethylene dichloride, vinyl chloride monomers, and PVC’s. Source: Business Wire 2010.

• A substantial number of companies are planning to expand methanol to olefins production at commercial scales. Currently there are three methanol to olefins plants with a capacity of 1.56 million tonnes, using coal based methanol inputs. Another nine such plants have been approved and are under construction, and thirty such plants are in the planning stage with a combined capacity of 20 million tonnes. It is estimated that half of these projects would be sufficient for China to become self-sufficient in ethylene supply (primarily from Coal).Source: Ken Yin 2012

• PetroChina is planning to build two coal to paraxylene facilities, one of the main building blocks of PTA for the production of polyester. The facilities are planned at a capacity of 1.6 million tonnesSource: Ken Yin 2012

While ambitions exist, the Chinese government has announced that it aims to cap methanol production capacity at 50 million tonnes by 2015. Current capacity is around 40 million tonnes, of which only 50% is utilized. I.E. half of the plants stand idle due to over-expansion of the industry. Beyond the obvious too fast expansion, there appears to be other strategic reasons such as potential competition over coal use for electricity, and restrictions on water availability to produce coal. Some other key challenges lie in the distance of the coal seams to major consumer markets, and competition over other fossil fuel feedstocks from the Middle-East.

Original article by Rembrandt at The Oil Drum

2 Comments:

But then the doomers will be talking about peak coal ie peak everything in an attempt at why it will fail.

Sure, and they also talk about climate catastrophe and every other form of doom they can imagine.

Have you ever seen such whiners as comment on some of those sites?

Post a Comment

Subscribe to Post Comments [Atom]

<< Home