These continuing increases in crude oil production are having profound effects on U.S. petroleum balances. A large portion of tight oil production consists of light, sweet crude oil. As previously noted by EIA, growing production has led to reduced imports of light, sweet crude oil on the U.S. Gulf Coast, the leading U.S. refining center. Without sufficient pipeline capacity to move all of the growing midcontinent production to the Gulf Coast, prices of these crudes, such as West Texas Intermediate (WTI), have declined compared to coastal grades such as Louisiana Light Sweet (LLS), reflecting the increased cost of moving the crude using marginal modes of transportation such as rail, barge, and truck. _USEIAUntil the US can reinstate rational energy policy -- including the necessary new pipeline infrastructure -- expect big windfall dividends for rail, barge, and tanker truck transportation.

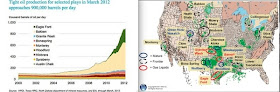

The graph at left shows how production has risen dramatically over the last decade from zero to almost 900,000 barrels a day, even though only two major reservoirs have been developed. The trend line splits the nine major fields by color coding. The Bakken – the cream-colored portion – has been by far the most productive, but the Eagle Ford in Texas is now starting to show results as well. The other seven fields have not yet entered full-scale production.

Most of the fields, but not all, are located on the map at the right. The Granite Wash is in western Oklahoma and Spring is in West Texas. The Monterey Shale, in central California, is believed to be the largest reservoir in North American, with four times the potential as the Bakken. (Why does California always get the best of everything?) The Woodford is not on this map but is beneath eastern Oklahoma, Texas and Arkansas. The Niobrara is at the juncture of Nebraska, Wyoming and Colorado. The Spraberry, also not shown, is in West Texas (which usually managed to be more productive than California). And the Austin Chalk, of course, is around Austin.

This vast potential of tight oil is the reason why the International Energy Agency and others are talking about the US achieving energy independence and even becoming an exporter by 2030. If the fields at the bottom of the graph begin to develop at anything like the rate of the Bakken and the Eagle Ford, the US is going to have a lot of oil. _RealClearEnergy

With increased production for both onshore and offshore US fields, the near to intermediate term outlook for US oil production is positive. As long as US pipeline infrastructure is underdeveloped, US oil prices will remain lower than international prices, with a concomitant energy dividend to US industries and the US economy.

The Obama administration has attempted to mandate green energy, and has carried out de facto wars against coal, nuclear, and offshore oil. The main reason that onshore tight oil production has thrived so quickly and thoroughly, is that it caught the Obama administration by surprise, before it could be suppressed.

As US oil & gas production continues to climb, expect rising environmental opposition -- at least some of it financed by overseas interests. Always follow the money, in business, politics, and in the faux environmental industrial complex.

It would be nice for the USA to be nearly energy self sufficient - before Iran starts dropping Nuclear weapons on Israel. When the Israelis retaliate - most of the infrastructure in the Middle East will be destroyed. And, the oil flow will slow to a trickle.

ReplyDelete